For young Australians working to get into the property market, there has never been a tougher time than right now. However, the Government’s latest budget includes a superannuation savings scheme that might let you still enjoy your smashed avocado brunches weekly while saving for a deposit within a few short years.

The First Home Super Saver Scheme announced in the 2017-18 Budget, will address the difficulties first home buyers face when they are saving for a deposit by helping them build it within their own superannuation account. The scheme which will cost the government an estimated $250 million in the next four years, is an updated and superior version of the plan first introduced by former Labor MP Kevin Rudd and axed by Tony Abbott in 2014.

The superannuation savings scheme comes into play on July 1, 2017, and will allow individuals to invest an extra $30,000 (or $60,000 for couples) on their existing compulsory super contributions from their pre-tax income. Individuals will be able to make voluntary contributions of no more than $15,000 in a single year, up to $30,000 in total over 10 years. These contributions will be taxed at 15 percent alongside the individual’s annual income and can be withdrawn at 30 percent lower than normal marginal tax rates, from 1 July 2018. When the time comes for individuals to put down a home deposit, withdrawals will not come from your retirement savings but solely from voluntary contributions and earnings.

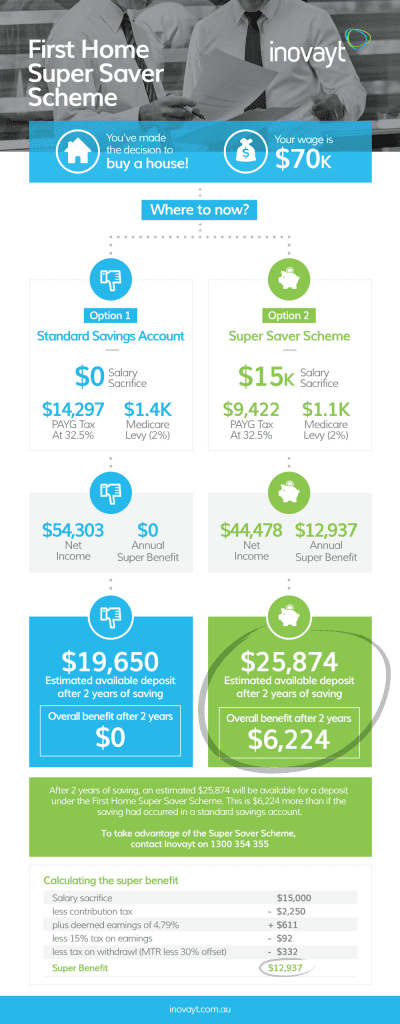

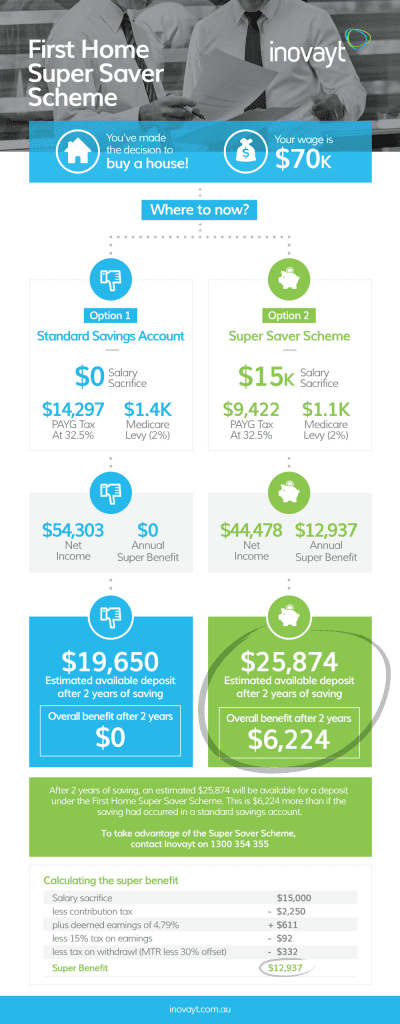

Please see below for the superannuation saving scheme breakdown over the two year period for the maximum $30,000 salary sacrifice.

If your employer doesn’t agree to salary sacrifice, you can still make contributions from your post-tax income and tax deduction claims on personal contributions. If you’re depositing your post-tax income, you won’t be taxed further when you withdraw it.

Rising house prices over the last 10 years have made it particularly difficult for individuals living in Melbourne and Sydney to own their own property. In Sydney, house prices have increased as much as 70 percent in the last five years and incomes by only 13 percent. Australians are entering the market later than previous generations and based on current standard saving strategies, saving the deposit for a home takes about 8 years in Sydney and 6 years in Melbourne.

The superannuation savings scheme is definitely worth considering for first home buyers and will reduce the barriers for those who typically struggle with standard saving accounts. The scheme will not only make it easier but also quicker for young Australians, and means that they will be able to earn a higher return on the money invested as it’s sitting in a super account as opposed to a regular savings account. Middle-income earners will benefit the most with the average individual saving about an extra $6224 over 2 years (or $12,448 for a couple) compared to just relying on a savings account.

Building a deposit inside your superannuation could put you ahead of your saving plans and get your foot in the property market easier. To take advantage of the government’s superannuation savings scheme, contact Inovayt to learn how much you could save.

If your employer doesn’t agree to salary sacrifice, you can still make contributions from your post-tax income and tax deduction claims on personal contributions. If you’re depositing your post-tax income, you won’t be taxed further when you withdraw it.

Rising house prices over the last 10 years have made it particularly difficult for individuals living in Melbourne and Sydney to own their own property. In Sydney, house prices have increased as much as 70 percent in the last five years and incomes by only 13 percent. Australians are entering the market later than previous generations and based on current standard saving strategies, saving the deposit for a home takes about 8 years in Sydney and 6 years in Melbourne.

The superannuation savings scheme is definitely worth considering for first home buyers and will reduce the barriers for those who typically struggle with standard saving accounts. The scheme will not only make it easier but also quicker for young Australians, and means that they will be able to earn a higher return on the money invested as it’s sitting in a super account as opposed to a regular savings account. Middle-income earners will benefit the most with the average individual saving about an extra $6224 over 2 years (or $12,448 for a couple) compared to just relying on a savings account.

Building a deposit inside your superannuation could put you ahead of your saving plans and get your foot in the property market easier. To take advantage of the government’s superannuation savings scheme, contact Inovayt to learn how much you could save.

If your employer doesn’t agree to salary sacrifice, you can still make contributions from your post-tax income and tax deduction claims on personal contributions. If you’re depositing your post-tax income, you won’t be taxed further when you withdraw it.

Rising house prices over the last 10 years have made it particularly difficult for individuals living in Melbourne and Sydney to own their own property. In Sydney, house prices have increased as much as 70 percent in the last five years and incomes by only 13 percent. Australians are entering the market later than previous generations and based on current standard saving strategies, saving the deposit for a home takes about 8 years in Sydney and 6 years in Melbourne.

The superannuation savings scheme is definitely worth considering for first home buyers and will reduce the barriers for those who typically struggle with standard saving accounts. The scheme will not only make it easier but also quicker for young Australians, and means that they will be able to earn a higher return on the money invested as it’s sitting in a super account as opposed to a regular savings account. Middle-income earners will benefit the most with the average individual saving about an extra $6224 over 2 years (or $12,448 for a couple) compared to just relying on a savings account.

Building a deposit inside your superannuation could put you ahead of your saving plans and get your foot in the property market easier. To take advantage of the government’s superannuation savings scheme, contact Inovayt to learn how much you could save.

If your employer doesn’t agree to salary sacrifice, you can still make contributions from your post-tax income and tax deduction claims on personal contributions. If you’re depositing your post-tax income, you won’t be taxed further when you withdraw it.

Rising house prices over the last 10 years have made it particularly difficult for individuals living in Melbourne and Sydney to own their own property. In Sydney, house prices have increased as much as 70 percent in the last five years and incomes by only 13 percent. Australians are entering the market later than previous generations and based on current standard saving strategies, saving the deposit for a home takes about 8 years in Sydney and 6 years in Melbourne.

The superannuation savings scheme is definitely worth considering for first home buyers and will reduce the barriers for those who typically struggle with standard saving accounts. The scheme will not only make it easier but also quicker for young Australians, and means that they will be able to earn a higher return on the money invested as it’s sitting in a super account as opposed to a regular savings account. Middle-income earners will benefit the most with the average individual saving about an extra $6224 over 2 years (or $12,448 for a couple) compared to just relying on a savings account.

Building a deposit inside your superannuation could put you ahead of your saving plans and get your foot in the property market easier. To take advantage of the government’s superannuation savings scheme, contact Inovayt to learn how much you could save.